“Banking While Black: How One CEO’s Quiet Power Shattered a $2 Billion Institution’s Racist Playbook—And Made Wall Street Beg for Mercy”

Excuse me, what are you doing here? The welfare office is three blocks down. Brad Mitchell’s voice sliced through First National Bank’s marble lobby like a scalpel. He looked up from his teller station with the kind of disdain that comes from years of unchecked privilege, his eyes scanning the black woman in the designer suit approaching his counter. Kesha Thompson’s breath caught, but her composure didn’t falter. The lunch crowd turned to stare as Brad’s smirk widened, his voice deliberately loud enough for everyone to hear. “This is a private banking institution, not a check cashing service,” he sneered. “You people always come in here trying to cash fake checks or pull some kind of scam.” He pointed toward the door as if shooing a stray animal. “ATM’s outside if you have an EBT card.”

The lobby fell silent except for the soft clicks of phone cameras—citizen witnesses, ready to document whatever happened next. Have you ever been treated like your money isn’t good enough simply because of how you look? The digital clock above the teller stations read 12:30 p.m. A brass placard near the entrance announced an executive committee meeting at 1:15. The branch would close for lunch at 2. Maya Patel, a freelance journalist in line behind Kesha, discreetly angled her phone, capturing every word for her Instagram Live. “Banking discrimination happening now at First National downtown,” her notification read. Kesha placed her withdrawal slip on the counter with deliberate calm. “I’d like to withdraw $25,000 from my account, please.”

Brad’s laughter was sharp and mocking. “$25,000, lady? That’s more money than most people see in a year. What kind of game are you running?” He snatched the slip, crumpling it slightly. “Let me guess. You’re going to tell me you’re some kind of business owner or executive, right? That’s what they all say.” The crowd was captivated, some customers whispering, “Call security.” An elderly black man shook his head in disgust, but said nothing. Susan Martinez, the branch supervisor, approached from her glass office, heels clicking authoritatively. “What seems to be the issue, Brad?” Susan asked, body language already aligned with her subordinate. “This person is trying to make a suspicious withdrawal,” Brad explained, voice carrying the weight of institutional authority. “$25,000—claims she has an account here.” Susan’s eyebrows rose. “That does sound unusual. Ma’am, do you have proper identification? We’ll need employment verification for any large withdrawals.”

Kesha reached into her purse, retrieving her driver’s license and a platinum banking card bearing the First National logo and her name in embossed lettering. Brad barely glanced at the documents. “Anyone can get fake IDs these days. The sophisticated ones even have the right logos.” He held up the platinum card like evidence in a trial. “These counterfeits are getting better every month.” Maya’s live stream viewer count climbed: 847, then 1,200. Comments began flooding in. “This is disgusting.” “Call the news.” “Where is this bank?” Kesha maintained her professional composure. “I’ve been banking here for six years. My account number is visible on both the card and my ID.” Susan stepped closer, creating a united front with Brad. “Ma’am, we have strict protocols for high-dollar transactions, especially from certain account types. These procedures exist to protect both the bank and our customers from fraudulent activity.” The phrase “certain account types” hung in the air like a poison cloud.

A security guard emerged from the back offices. Jerome Washington, a 10-year veteran whose uncomfortable expression revealed his recognition of the situation’s true nature. His presence was meant to intimidate, but his reluctance was visible. “Jerome, we may need assistance with this situation,” Susan announced loudly. “Potential fraud case.” Kesha’s phone buzzed against her leg—a Federal Reserve conference call reminder for 2:00 p.m. She silenced it, but the motion wasn’t lost on the growing audience. “Look, lady,” Brad said, leaning back in his chair. “I deal with this stuff every day. People come in here with sob stories, fake documents, trying to charm their way into quick cash. It’s not going to work.” He gestured at the marble columns and crystal chandeliers. “This is First National Bank, not some corner check cashing place. We serve serious clients with serious money.” A businessman muttered, “Just give her the money if she has proper ID.” But a middle-aged white woman nodded approvingly at Brad’s vigilance.

“We’re going to need to verify your employment status,” Susan continued, pulling out a thick folder of forms. “Income verification, source of funds documentation, and a detailed explanation of what you plan to do with this money.” Kesha’s leather portfolio rested on the counter, unopened. Inside were board meeting documents and contracts that could reshape the entire banking industry. But these people saw only skin color, making assumptions based on nothing but prejudice. “The system shows some irregularities with this account,” Brad lied smoothly, pretending to study his computer screen. “Multiple red flags that require additional verification procedures.” Maya’s live stream hit 1,847 viewers. The hashtag #bankingwhileblack was gaining momentum. Screenshots of Brad’s dismissive expressions were being shared on Twitter and Instagram.

The overhead speaker announced, “Executive meeting in 45 minutes. All department heads, report to the conference room by 1:10 p.m.” The countdown added urgency. Susan checked her watch nervously; she needed to prepare for the meeting, but this incident required her attention. “Ma’am, I’m going to have to ask you to step aside while we process this verification,” Susan said, gesturing toward a small waiting area near the security desk. “This could take some time.” The suggestion was designed to humiliate, forcing Kesha to wait like a suspect while “real” customers conducted their business. Jerome shifted uncomfortably, recognizing the psychological manipulation but bound by employment to follow Susan’s lead. Maya’s phone showed 2,000 viewers now, comments pouring in from people who recognized the systematic nature of what they were witnessing. The story was spreading beyond the bank’s marble walls.

But none of them knew what was coming next. “Executive meeting in 30 minutes. All managers do conference room preparation.” The announcement crackled through First National System as the lunch crowd began to thin. Maya’s live stream reached 3,400 viewers, major news outlets beginning to take notice. Regional manager David Chen burst through the executive elevator doors, his expensive suit and hurried pace commanding attention. Someone had called him about a situation requiring immediate damage control. “What’s the problem here?” David demanded, scanning the scene. Susan rushed to brief him, speaking in hushed tones designed to exclude Kesha. “Potential fraud case, sir. Large withdrawal request with suspicious documentation. Brad identified multiple red flags in the system.” David nodded gravely, expression shifting into crisis management mode.

“Ma’am, I’m David Chen, regional manager for First National,” he announced formally. “I understand there’s been some confusion about account verification procedures.” Kesha remained composed, but Maya’s camera caught the slight tightening around her eyes. “There’s no confusion, Mr. Chen. I’m simply trying to withdraw money from my own account.” “These elaborate schemes are becoming increasingly common,” David continued, loud enough for the crowd. “Identity theft, document forgery, social engineering—criminals are getting very sophisticated.” Jerome Washington stood nearby, his security uniform making him complicit in what was clearly becoming a racially motivated interrogation. “Sir, perhaps we should move this discussion to a private office,” Jerome suggested quietly. “No, Officer Washington,” David replied. “Transparency is important in fraud investigations. Other customers should see how seriously we take security.”

Maya’s live stream comments exploded with outrage. “This is discrimination.” “Sue them.” “Call the NAACP.” Viewer count hit 5,200 with shares multiplying. A well-dressed elderly woman approached the counter. “Excuse me, I need to make a deposit before you close for lunch.” “Ma’am, we’re dealing with a security situation,” Brad explained. “This woman is trying to withdraw a very large sum with questionable documentation.” The elderly customer looked at Kesha with suspicion. “Well, I suppose you have to be careful these days. All sorts of people are trying to take advantage.” But another voice cut through the tension—a young black professional from the loan officer area. “This is ridiculous. She has proper ID and a bank card. What more do you need?” “Sir, please don’t interfere with bank security procedures,” Susan warned. “We have protocols for a reason.”

The lobby was divided into camps. Some customers supported the bank’s vigilance, others recognized the obvious discrimination. Maya’s phone captured every reaction, every moment of institutional bias playing out in real time. “I’m going to need additional documentation,” David announced, pulling out a thick packet of forms. “Employment verification, tax returns, proof of income source, and a detailed affidavit explaining the purpose of this withdrawal.” Kesha’s phone buzzed insistently. Texts from her assistant, board members asking about the Federal Reserve call, another from her lawyer: “Saw the live stream. Want me to intervene?” She ignored them all, maintaining dignified composure. “This is standard procedure for large withdrawals,” David continued, though everyone knew it wasn’t. “We’re protecting both the bank and the legitimate account holder from potential fraud.”

“Executive meeting in 20 minutes,” came another announcement. The time pressure was building. “Ma’am, we’re also going to need to contact your employer to verify your identity,” David added. “What company do you work for?” The question was loaded with assumptions. In David’s mind, this woman was probably unemployed or working minimum wage. “I’m self-employed,” Kesha replied calmly. Brad snorted. “Self-employed? Right. Let me guess. You’re a consultant or entrepreneur with no real income verification.” Maya’s live stream audience had grown to 7,800 viewers. Major news organizations were embedding the feed. The hashtag #firstnationaldiscrimination was trending nationally.

Jerome approached Kesha with obvious reluctance. “Ma’am, I’m going to need you to provide additional identification—driver’s license, social security card, and any employment documentation you might have.” His tone was apologetic, but his position forced compliance with discriminatory policies. Kesha handed over her documents without protest, recognizing that resistance would only escalate the situation. “Jerome, run these through the fraud detection system,” David instructed. “Check for any red flags or suspicious patterns.” The fraud detection system was really just David’s way of stalling while he figured out how to handle the growing crowd of witnesses and recording devices.

A group of young professionals entered, immediately drawn to the commotion. One, a black woman in her 30s, started her own recording. “Are you seriously harassing this woman over a withdrawal?” she challenged. “This is 2024, not 1964.” “Ma’am, please don’t interfere with bank security procedures,” Susan replied. “We have the right to verify large transactions.” “Show me the policy that requires this level of verification,” the woman demanded. “I’ve made larger withdrawals without any problems.” Susan’s face flushed with anger. “Our policies apply equally to all customers. This has nothing to do with personal characteristics.” But everyone could see through the lie.

The contrast was obvious—other customers conducting transactions without harassment, while Kesha faced an inquisition. Maya’s phone battery was dropping, but backup streams had started. The story was beyond containment, spreading through news networks, social media, and civil rights organizations. “Executive meeting in 15 minutes. All departments head to the conference room immediately.” David’s radio crackled with an urgent message. “Mr. Chen, corporate security needs to speak with you about the live stream situation.” The corporate office had noticed. Lawyers were probably being called. Crisis management protocols were activated, but it was too late to contain the damage.

“Ma’am, we’re going to need you to wait while we complete our verification process,” David announced. “This could take several hours.” The threat was clear: submit to humiliation or be denied basic banking services. But Kesha’s calm expression never wavered. Even as the institutional weight of discrimination pressed down, Jerome looked away, unable to meet her eyes. He knew this was wrong, but his mortgage depended on following orders. Maya’s live stream hit 12,400 viewers. Comments poured in from civil rights lawyers, financial industry insiders, and journalists recognizing the significance of what they were witnessing.

The stage was set for something that would change everything, but none suspected what was about to happen. “Executive meeting in 10 minutes. All managers report immediately.” The announcement seemed to trigger something in Kesha Thompson. She slowly opened her leather portfolio for the first time, her movements deliberate and controlled. The crowd leaned forward, sensing a shift. Maya’s live stream reached 15,600 viewers with notifications flooding her phone as major news outlets began covering the story in real time. Comments streamed past: “Something’s about to happen.” “She’s too calm.” “This woman knows something.”

Kesha withdrew a single business card, its embossed lettering catching the crystal chandelier light. She placed it gently on the counter in front of Brad Mitchell, who glanced at it dismissively. “Kesha Thompson, President and CEO, Thompson Financial Group,” Brad read aloud, voice dripping with skepticism. “Another fake business card. They’re making these things in China now for $5 each.” But David Chen stepped closer, squinting at the card with growing unease. Something about the quality, the font, the paper weight triggered corporate memory. The name “Thompson Financial Group” stirred recognition from executive briefings.

Kesha handed him a second card, this one bearing the First National Bank logo alongside legal text: Board of Directors, Preferred Shareholder, Series A, Voting Rights. The color drained from David’s face. His hands trembled as he read the text. “You… you’re on the board?” he stammered. “I don’t just sit on the board, Mr. Chen,” Kesha replied, her tone carrying a new quality that made everyone lean forward. “Thompson Financial Group owns 31% of First National Corporation. We’re the largest single shareholder.” The words hit the crowd like a physical force. Brad’s mouth fell open, the business card slipping from his fingers. Susan Martinez backed away from the counter as if it had caught fire. Maya’s live stream exploded. Viewer count jumped from 15,600 to 28,400 in 30 seconds. Comments flooded the screen: “Oh my god. She owns the bank.” “Plot twist!” “This is insane.”

News organizations worldwide embedded the feed into breaking news coverage. Jerome Washington shook his head slowly, recognition dawning. He’d seen Thompson’s photo in corporate newsletters, annual reports, board meeting announcements. The woman they’d been harassing for 40 minutes was literally their boss’s boss’s boss. “Thompson Financial Group acquired our controlling interest eight months ago,” Kesha continued, opening her portfolio to reveal documents that made Brad’s eyes widen further. “Today’s executive meeting,” she gestured toward the conference room, “is my quarterly board review.”

The lobby fell into stunned silence. Customers who’d been watching discrimination now found themselves witnessing corporate history. Maya’s phone captured every facial expression, every moment of realization, every second of the most expensive customer service failure in banking history. “The quarterly meeting agenda includes customer experience assessment,” Kesha explained, pulling out a folder marked confidential board review. “I’ve been conducting anonymous visits to all First National branches as an ordinary customer.” She looked directly at Brad, who seemed to be having trouble breathing. “Today’s interaction was specifically designed to test frontline customer service protocols. You’ve provided exceptional data for our discrimination analysis.”

The elderly couple near the loan department exchanged horrified glances. The businessman who’d earlier supported Brad’s vigilance was frantically deleting his social

News

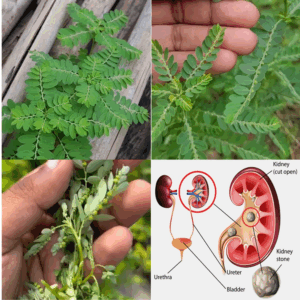

Seeing this plant is like finding “gold” in the garden, don’t throw it away…..

Stone Breaker (Phyllanthus niruri): A Miracle Herb with 25 Benefits and Practical Ways to Use It Phyllanthus niruri, known as Stone Breaker, is a powerhouse plant used…

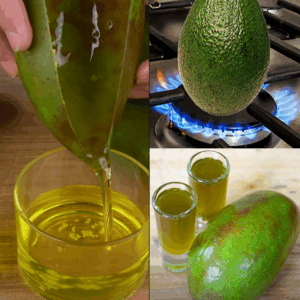

Don’t throw away your DAMAGED AVOCADOS, turn them into OIL without spending so much.

Here’s the secret why everyone puts avocados on the fire! We all adore avocados – creamy, delicious, and packed full of health benefits. But did you know…

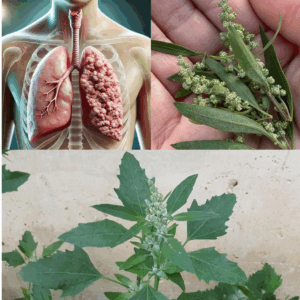

Most people think it’s a weed, but this plant is actually a real treasure…

The Health Benefits and Uses of Broadleaf Plantain (Plantago major) Broadleaf plantain (Plantago major) is often overlooked as a mere weed in many backyards and gardens. However,…

To keep receiving my recipes, you just need to say one thing…

10 Powerful Benefits of Castor Leaves You Probably Didn’t Know About When people think of the castor plant (Ricinus communis), they usually think of castor oil. But…

They grow everywhere, most think these are weeds, but they’re real treasures…

Lamb’s Quarters/Wild Spinach: The Underestimated Superfood with Maximum Health Benefits Amidst the plethora of edible plants, Lamb’s Quarters, or Chenopodium album, emerges as a remarkable yet underappreciated superfood….

Say goodbye to high cholesterol, poor circulation, hypertension, chest discomfort, and stress. How to prepare it…

The Power of Hawthorn (Genus Crataegus): A Natural Ally for Heart and Cholesterol Health Hawthorn, a small thorny shrub or tree from the genus Crataegus, has long been…

End of content

No more pages to load